For decades, courts, state agencies, and state legislatures continue to ask the wrong questions in regards to state sales tax. This continuing practice has led to decades of inconsistent decisions in different states with similar laws. At the heart of the issue is the notion that the states have continually asked the wrong questions related to the policy and design of a sales tax regime. How could taxpayers expect correct results when the states continue to ask the wrong questions? However, it is this inconsistency that has allowed multi-state sales and use tax lawyers to continue to thrive in a marketplace growing with technology and complexity.

Without getting into a tedious history of a sales tax, the sales tax was essentially created during the Great Depression in the 1930’s. The first sales and use tax laws were hastily and poorly drafted and were copied from state to state to state. The sales tax regime was designed to tax individuals on the price of goods acquired for personal consumption. Conversely, the tax should not apply to the purchases made for business use, or what is known as “business inputs.”

In the early days, the easiest (not necessarily the correct) technique was to tax the retail sale of tangible personal property (“TPP”). It is this primitive ideal which is embedded in the original sales tax laws that have grown outdated and have created many of the issues in our much more complex economy of the 2000’s. Even with the changing of the times and the economy, our lawmakers and courts continue to ask the age old question that comes along with the foundation of the sales tax policy and design. Courts and lawmakers continue to struggle with what is “TPP” as opposed to real property. Why has no one stopped to think whether this should be the question at all? Shouldn’t the question be whether the goods are personally consumed as opposed to a business input? It is this fundamental problem and the states’ unwillingness to ask the correct question that has led to many of the inconsistent and puzzling rulings each year. This age old question has been and will continue to be problematic in effectively administering a state sales tax. However, the states’ stubbornness to ask the correct question will provide job security for multi-state sales tax attorneys for years to come.

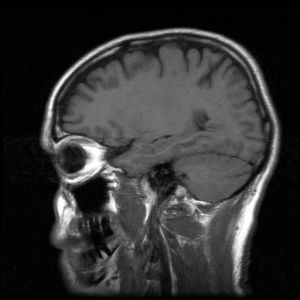

In a recurring classic example, Northeastern Pennsylvania Imaging Center v. Pennsylvania, 35 A. 3d 752 (Pa. 2011), the Supreme Court of Pennsylvania was faced with whether an MRI and PET Scan system purchased for over $2 million was subject to sales tax. The system weighed in excess of 15,000 pounds, took five days to install, could only be moved by crane, was anchored into the concrete beneath the floor, and could only be removed by removing the exterior wall.

Continue reading

Multi-State Tax Law Blog

Multi-State Tax Law Blog